The State of Canada’s Aviation Sector: Current Situation and Recovery Outlook

Canada’s aviation industry has suffered a significant downturn in activity levels, revenues, and employment over the past year and a half since the onset of the COVID-19 pandemic in March of 2020. While the recovery of the nation’s commercial aviation sector is underway Canadian airports and airlines find themselves at lower recovery levels than many other nations and markets, particularly our neighbour to the south seeing recovery to above 80% of 2019 values this year. This article looks at the current situation of Canada’s commercial aviation industry and key factors which are and will continue to influence the path of the recovery in passenger travel over the coming months.

Current Situation in Canada

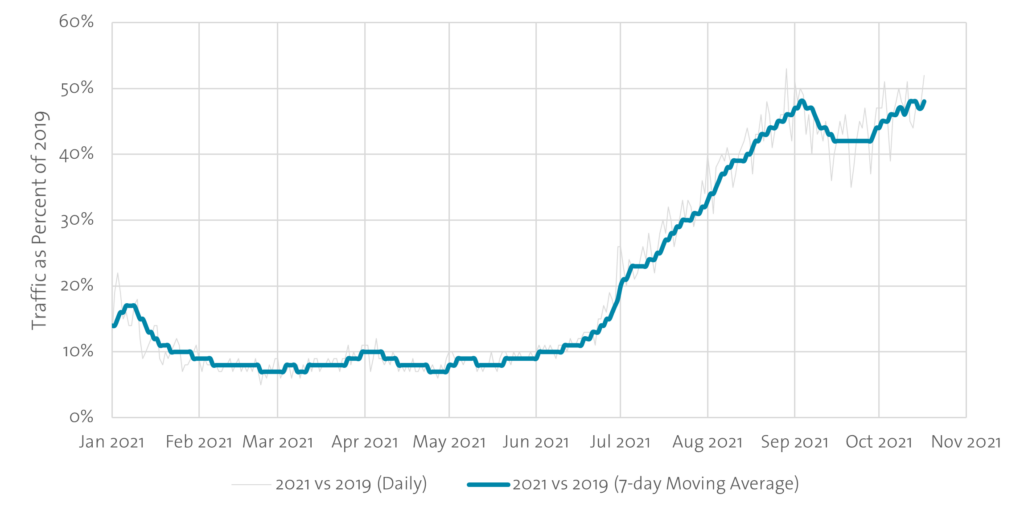

Air passenger volumes in Canada generally remained below 10% for much of the first half of 2021 relative to the same time period in 2019 before the pandemic. While there were minor signs of recovery growth in December 2020 and January 2021, new policies put in place by the Government of Canada in January 2021 mandating pre-departure negative COVID tests and strengthening the quarantine requirements on entry to Canada dampened demand for winter season international travel. For remainder of the first half of 2021, passenger traffic levels remained at or below 10% of 2019 levels as shown in Figure 1 below. The first significant recovery trend in passenger traffic began in June 2021 as mass vaccination of Canadian adults covered more and more of the population and coinciding with the easing of public health restrictions leading to an increase in travel demand. While international travel has remained very limited, domestic travel in Canada saw significant recovery during the Summer of 2021 with total passenger recovery hitting a peak of over 50% to 2019 on some days at the end of Summer.

Figure 1: CATSA Screening Throughput, 2021 vs. 2019

As Summer turns to Fall, with leisure travel dipping as students return to school, industry observers questioned how sustainable the recovery trajectory seen during the Summer of 2021 would be as we moved towards the fourth quarter and a traditionally (pre-pandemic) stronger business travel period. While passenger levels did dip briefly in the first half of September a minor bounce-back appears to be under way, with October data suggesting a trend towards the summer peak of traffic but still below half of pre-pandemic activity levels.

Growing Roles for Smaller Players

The major disruption to the Canadian aviation sector caused by the pandemic has modified the nation’s airline network. As carriers have looked to reduce costs in a period of low demand, fleets and networks have changed in response such as the retiring of older aircraft and reducing or eliminating certain network links at many of Canada’s smaller and regional airports. These network changes, primarily by Canada’s two largest carriers Air Canada and WestJet, have created unique opportunities for some smaller airlines to create new linkages between city pairs and backfill capacity that has been lost by others.

Flair Airlines and PAL Airlines are the largest of the two smaller carriers demonstrating this trend. The ULCC and regional carrier made up less than 1% each of Canada’s total seat capacity prior to the pandemic. Capitalizing on opportunities caused by the pandemic Flair is set to increase their capacity share to 4% and PAL to increase to 2% of the national total. While the shares of capacity remain small, the growth demonstrated by these carriers highlights how the pandemic’s impact on major airline networks can create spaces for other entrants to build and grow. For Flair, the ULCC has added new capacity and unique non-stop services to destinations which were significantly reduced or even eliminated by major network carriers during 2020. Similarly for PAL, the regional carrier has expanded out of Atlantic Canada and is building regional networks through Atlantic, Eastern, and Central Canada, providing connectivity to Canada’s smaller and regional airports and communities and in many cases providing capacity and connectivity on routes terminated by major carriers due to the pandemic. PAL’s development of interline agreements with Air Canada and WestJet are bringing back an “everything old is new again” business model and success in this area may provide a more positive recovery outlook for Canada’s smaller and regional airports.

Upcoming Health Policy Changes

In August of 2021 the Government of Canada started a series of mandates regarding vaccination requirements and the aviation industry. Early August saw the announcement that employees in federally regulated industries – including the air, rail, and maritime transportation sectors – must be vaccinated. In early October 2021 it was announced that all travellers at Canadian airports must be vaccinated for both domestic and international travel starting in late October. The rollout of a national app to prove vaccination status, along with ongoing provincial efforts on vaccine passports, will be advancing in November of 2021 Very few exemptions to the vaccine requirement are to be allowed and proof of a negative COVID test will not be approved as a substitute. In general travellers within and to/from Canada must be vaccinated. These measures have been instituted to protect the safety of employees and travellers and to reduce the transition of COVID-19 within the country and across borders. Canada’s major airlines have broadly supported the vaccination requirements, both to protect the safety of their employees and to look towards continued recovery and growth of air travel in a fully vaccinated industry.

With 82% of Canada’s population 12 and over having been fully vaccinated as of late October the policy, and with vaccination rates continuing to grow, the vast majority of the travelling public is set and ready to travel in the future. However, for the portion of the population who choose not to be vaccinated will effectively be shut out of commercial air travel come November. These public health policy developments continue to incentivize vaccination of Canadians and follow on the removal of the 14-day quarantine requirement for fully vaccinated travellers arriving in Canada to assist in reducing the barriers to international travel while managing the risk of COVID-19 transmission.

The longer-term future of vaccination requirements to fly in Canada, particularly for domestic travel, does add additional risk to the outlook for the industry’s recovery. As it is likely there will remain a portion of the population who choose not to be vaccinated, and who are not in the small group of allowable exemptions from Transport Canada, that will be a segment of the Canadian aviation market which will remain untapped. How long vaccine mandates may last, and what effect vaccine mandates have on encouraging further vaccination remain important questions in the path of the nation’s aviation sector recovery.

Canada has (at the time of writing) not yet followed the United States in the recognition of World Health Organization-approved vaccines. While the UK, Europe and other geographies have a similar set of vaccines as Canada (Pfizer, Astra Zeneca, etc.), WHO vaccines are commonplace with SinoVac and SinoPharm as dominant in many geographies. With the United States allowing these vaccines as recognized, the scenario will be advanced that a traveler from Asia would be permitted to enter the United States with limited issues, but would still be subjected to self-isolation requirements in Canada. This has a material impact on the potential for Canada to recover its international traffic.

Testing and the Cost of Travel

The past three decades have seen a long-term trend of declining real costs of air travel in Canada, mirroring the improvements in efficiency and reducing costs to travellers seen across the world. This historical trend has allowed Canada’s aviation sector to grow by allowing more people to travel and at lower real costs than in years past, with real airfares in Canada declining by -14% overall in the ten years between 2009 and 2019.[1] However, as a result of the COVID-19 pandemic and government health policies, new costs to travellers are emerging in the form of COVID-19 testing requirements for international travel, costs which threaten to reverse the trend of declining real costs of air travel.

Current requirements from the Government of Canada state that all travellers entering Canada, regardless of their nationality or vaccination status, must provide a valid molecular COVID-19 test result taken within 72 hours of departure to be allowed into Canada. While COVID testing has become largely the norm for international travel in 2021, the requirement for molecular tests such as PCR and NAAT tests imposes additional costs on travellers. Often costing CA$200 or more per person per test, these tests can add significantly to the overall cost of travel for travellers entering Canada be it for leisure or business. There are also chronic shortages of capacity for PCR and NAAT. The United States is in November 2021 adopted a risk-based approach of air travel subject to full vaccination, plus rapid antigen tests. Rapid antigen is significantly less expensive (20-25% the cost of PCR tests). In particular for more price-sensitive leisure sectors, adding hundreds of dollars to the effective cost of travel to account for testing is likely to have a cooling effect on the recovery of demand for international travel. How long testing requirements remain in place, whether testing requirements could be eased for vaccinated travellers, or if testing costs comes down (or by accepting less expensive antigen tests) will all impact this pricing effect on the recovery of demand.

To conclude we summarise the major factors of the recovery of the Canadian commercial aviation sector so far and those factors which will shape the future of the recovery in the months and years to come.

- The recovery of air traffic in Canada is well underway in 2021 reaching nearly 50% recovered to pre-pandemic levels in 2021Q3. There are uncertainties over how the next few months will unfold and if recovery levels will remain as the peak summer leisure travel period passes and business travel remains relatively limited.

- Smaller airlines are making up a larger share of national capacity by capitalizing on opportunities caused by the disruption of the pandemic. The pandemic has created new space for ULCCs and regional airlines to open new non-stop pairs and build regional networks to backfill capacity reduced or lost during the early stages of the pandemic. Their development provides a boost to the recovery of passenger traffic in Canada’s smaller communities and airports.

- New vaccination regulations could impact demand potential as, in the short term, there will be a portion of the Canadian population who will be effectively unable to fly due to choosing not to be vaccinated. The long-term effects of this regulation, and how long such a regulation will remain in force, are uncertain but do add downward pressure to the recovery outlook for Canada.

- Lack of Canadian recognition of WHO-approved vaccines will dampen the impact of many geographies that have used Sinovac, Sinopharm and other vaccines that are not exempted from self-isolation requirements on arrival to Canada. Business travel from Asian markets, for example, will be negatively impacted.

- Testing requirements are leading to increases in the cost of air travel which could continue to slow the recovery of international travel to/from Canada. How long the current testing regime will continue, and if it will see modifications to reduce the cost to travellers, will impact the path of recovery for international air travel in Canada.

[1] Statistics Canada. Table 23-10-0036-01 Domestic and international average air fares, by fare type group, quarterly. InterVISTAS analysis.

Contact Us

Ready to get started? Let’s work together on finding solutions that work for you. Get in touch and let us know how we can help!

Contact Us